Yahoo has generated a lot of press and discussion in recent months due to a whole spectrum of reasons. From its numerous acquisitions of tech companies led by its billion dollar acquisition of Tumblr to its recent firing of COO, Henrique de Castro with a $100M plus payout after only a year’s tenure. It also has hired celebrity journalists Katie Couric and David Pogue, seen its stock price soar to levels unseen for years and have its luminary Silicon Valley CEO giving speeches in every forum she can get too.

However since Marissa Mayer took over as CEO in the Summer of 2012, Yahoo still has the same (if not worse) identity problem it had when she took over. Throughout the tenure of her recent predecessors Ross Levinsohn, Scott Thompson, Carol Bartz and even co-founder Jerry Yang, none of them could either succinctly or believable answer the simple question; What is Yahoo?

Mayer has been given a break throughout her initial 18 month tenure by most in the media and on Wall Street largely because Yahoo’s share price has doubled since she took office and also because of the golden halo she earned from her very successful tenure at Google since its early days. She wanted to turn Yahoo into a cool company again for visitors to its properties and a place where the best in technology would want to work. In doing this she wanted Yahoo to more wholly embrace mobile and again embrace building technology in house.

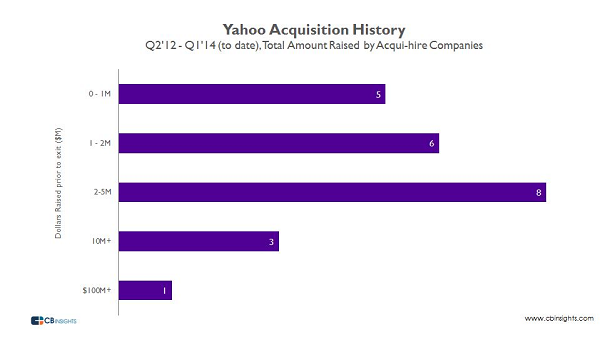

Figure 1: Yahoo Acquisitions

All of these are laudable goals and rightly so she has been given time and the latitude to fundamentally change Yahoo. In many ways she has succeeded beyond just the stock price as she;

- Launched a few highly praised mobile products like Yahoo Weather

- Largely via acquisitions she has incorporated many of the smarted engineers in the world under the Yahoo banner including young stars David Karp, the founder of Tumblr and Nick D’Aloisio, founder of Summly

- For a brief period according to a couple of vendors Yahoo surpassed Google in the US in terms of total traffic to its own properties

- Recruited high profile media personalities from the New York Times and the major TV networks

- Unlocked cash from Asian investments in Alibaba and Yahoo Japan primarily which allowed her to fund the 37 acquisitions made to date

Below the Surface

However herein lies the problem. She wanted to get away from the Yahoo media portal and display ad model that previous CEO Levinsohn advocated but in hiring major news personalities and acquired news and content related startups she is really pushing in that direction. She also wanted Yahoo to get back to building technology again, yet other than revamps and better designs to existing products like Flickr, Yahoo Mail, Yahoo.com, etc., Yahoo has released nothing new of note in the technology realm that has gained major traction in the technology world.

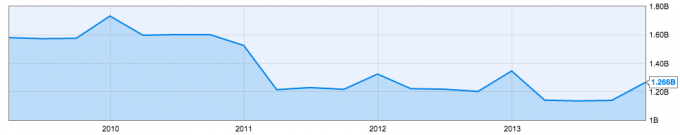

Figure 2: Yahoo Quarterly Revenue

The we have Yahoo’s financial situation. When Mayer took over in mid 2012, Yahoo’s stock price was in the mid teens and now it hovers around $35. Looking at that revenue chart we can see that not only has Yahoo’s revenue declined since she took over, it is way down from the time that Bartz was CEO and was criticized by everybody. So you may ask how does a company with declining revenues actually become more valuable?

Well this is where Alibaba comes in. Alibaba is China’s answer to Amazon amongst other things and as recently as September and October it expected IPO valuation was raised from 100B to 190B. Bear in mind Yahoo’s total market capitalization is around $36B. Yahoo has a 24% stake in Alibaba from an early investment made by co-founder Jerry Yang and is obligated to sell about 40% of those shares at time of IPO which will probably come sometime this year. That stake when sold could be about $10B after tax and the total holding would be around $36B. In other words the entire value of Yahoo is it’s stake in Alibaba and the rest is essentially worth nothing, at least according to the market.

Now when you hear Yahoo on their recent earning calls when asked to highlight the positive aspects of their business they point largely to engagement and traffic metrics, as well as their hiring wins. These are the type of things a pre Series A to Series C venture backed company might talk about to investor when highlighting performance and seeking funding. Yahoo is of course a company that has been public for about 15 years and is about 20 years old. It is one of the original internet companies that is still a major brand today.

Finally if you talk to any engineer on the east or west coast in the US or great ones around the world, Yahoo is very low if at all on their desired companies to work. Many of course want to found their own companies and create the next big thing. The next group of companies they want to join are the glamor innovative venture back startups of today like Uber, Dropbox, Airbnb, Pinterest, Spotify, SoundCloud, etc. Finally if they want to join the mature technology brands then Google, Apple, Amazon, Facebook, Twitter and even Microsoft still carry far more opportunity and cache than Yahoo. Therefore if it wasn’t for the million dollar to billion dollar payouts to the various founders and engineers and the acquired companies would they ever have joined?

Sarah Lacy founder at Pando Daily and Kara Swisher, founder at Re/code.net and persistent pain in the ass of every Yahoo CEO with her knack of leaking everything the board and company is doing have written recently about this and pointed out many of these home truths. Ultimately noone really knows what Yahoo is other than a legacy internet brand that people use to find news, financial news and quotes, entertainment gossip, email, messaging products, photo sharing on flickr, tumblr blogging and occasionally some on their new mobile products and as a search engine.

31% of their revenue today comes from their guaranteed minimum revenue per search deal with Microsoft and that proportion has been rising as Yahoo’s search share has continued to decline. Most of their revenue still comes from selling display ads against their audience traffic. Although from their halcyon days as the Display leader only 3 or 4 years ago, their revenue has continued to decline and they have dropped behind Google and Facebook in display ad revenue. There is talk about Yahoo building their own search technology again but even if they did who would use it?

Yahoo is a company who is maybe where the New York Times was 10 years ago. It is a profitable company with valuable media assets and brand but with clear danger signs in the market and a change in the technology landscape that will likely leave them behind. If they can pivot like the Times is trying to into a digital subscription property with a leaner workforce then maybe it will succeed as a digital media property.

The reality is Yahoo, save for an Apple or IBM 90s like revolution, will never be a major force in the technology world again.